What Does Paul B Insurance Mean?

Wiki Article

Not known Factual Statements About Paul B Insurance

Table of ContentsPaul B Insurance Can Be Fun For EveryoneThe 2-Minute Rule for Paul B InsuranceThe Best Strategy To Use For Paul B InsuranceThe Greatest Guide To Paul B InsurancePaul B Insurance for BeginnersPaul B Insurance - Truths

stands for the terms under which the insurance claim will be paid. With residence insurance, for example, you might have a replacement price or actual cash worth policy. The basis of just how cases are resolved makes a huge impact on just how much you obtain paid. You should constantly ask how claims are paid and what the cases process will be.

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

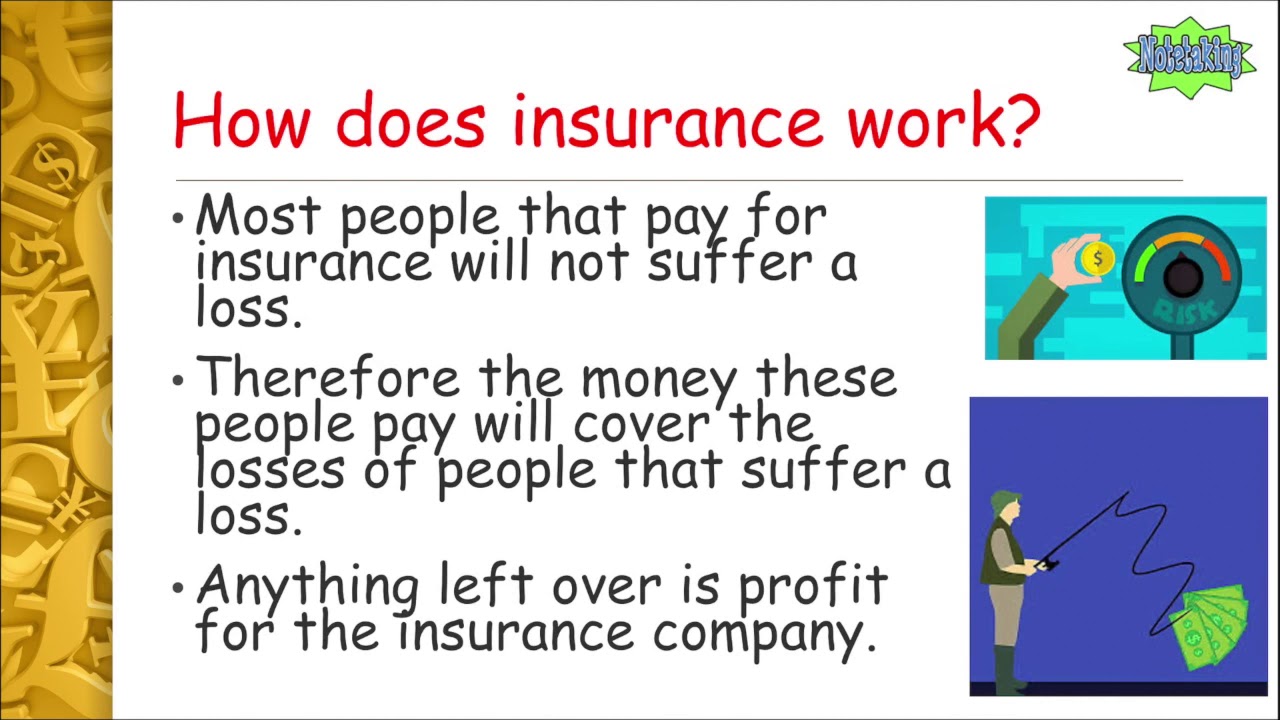

The idea is that the cash paid in cases gradually will be much less than the overall costs collected. You might feel like you're throwing money gone if you never submit a case, yet having piece of mind that you're covered on the occasion that you do suffer a significant loss, can be worth its weight in gold.

The 6-Second Trick For Paul B Insurance

Visualize you pay $500 a year to guarantee your $200,000 residence. You have ten years of making settlements, and you've made no insurance claims. That appears to $500 times one decade. This means you have actually paid $5,000 for residence insurance. You begin to question why you are paying a lot for nothing.Since insurance coverage is based upon spreading the threat amongst many people, it is the pooled money of all individuals paying for it that permits the firm to develop possessions and cover insurance claims when they happen. Insurance coverage is a company. It would be nice for the companies to just leave prices at the same degree all the time, the fact is that they have to make enough money to cover all the prospective insurance claims their policyholders may make.

just how a lot they entered premiums, they need to change their prices to make cash. Underwriting changes and price rises or reductions are based on outcomes the insurance provider had in previous years. Depending on what company you acquire it from, you might be handling a restricted representative. They market insurance coverage from only one business.

A Biased View of Paul B Insurance

The frontline people you deal with when you acquire your insurance policy are the agents as well as brokers that represent the insurance policy business. They an acquainted with that business's products or offerings, however can not speak towards various other business' plans, rates, or product offerings.They will certainly have access to more than one company and also have to learn about the variety of items supplied by all the companies they stand for. There are a couple of straight from the source crucial concerns you can ask on your own that could aid you determine what kind of protection you require. Just how much danger or loss of money can you presume by yourself? Do you have the cash to cover your expenses or debts if you have a mishap? What concerning if your residence or auto is spoiled? Do you have the savings to cover you if you can't work because of a crash or ailment? Can you manage higher deductibles in order to minimize your expenses? Do you have special needs in your life that require added coverage? What advice problems you most? Plans can be tailored to your requirements and also recognize what you are most worried about safeguarding.

The insurance policy you need varies based upon where you are at in your life, what kind of assets you have, as well as what your long-term goals as well as obligations are. That's why it is crucial to make the effort to review what you want out of your policy with your agent.

The Best Strategy To Use For Paul B Insurance

If you secure a car loan to acquire a vehicle, and afterwards something occurs to the cars and truck, void insurance policy will pay off any kind of portion of your car loan that basic vehicle insurance policy doesn't cover. Some lending institutions need their debtors to carry space insurance coverage.The main objective of life insurance policy is to give money for your beneficiaries when you pass away. Just how you die can determine whether the insurance company pays out the death benefit. Depending on the kind of policy you have, life insurance can cover: Natural fatalities. Dying from a heart attack, illness or seniority are examples of natural deaths.

Life insurance policy covers the life of the insured person. The insurance policy holder, who can be a different person or entity from the insured, pays premiums to an insurance coverage business. In return, the insurance firm pays out an amount of cash to the beneficiaries noted on the policy. Term life insurance covers you for a duration of time chosen at acquisition, such as 10, 20 or thirty years.

The Ultimate Guide To Paul B Insurance

Term life is preferred due to the fact that it supplies big payouts at a lower price than permanent life. There are some variants of typical term life insurance coverage policies.Long-term life insurance coverage policies build cash value as they age. The cash worth of entire life insurance policy plans grows at a fixed rate, while the cash money worth within universal plans can rise and fall.

check this site out

If you compare average life insurance policy prices, you can see the difference. $500,000 of entire life coverage for a healthy and balanced 30-year-old female prices around $4,015 each year, on standard. That same degree of protection with a 20-year term life plan would cost a standard of concerning $188 annually, according to Quotacy, a brokerage company.

Little Known Questions About Paul B Insurance.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

Report this wiki page